Impact of student loan debt on degree completion rates is a critical issue facing higher education today. The crushing weight of debt significantly impacts not only a student’s ability to graduate on time but also their academic performance, mental health, and future career prospects. This exploration delves into the complex relationship between student loan debt and degree completion, examining the correlation between debt levels and graduation rates, the impact on academic performance and well-being, and the influence on post-graduation choices.

We’ll also uncover strategies for mitigating the negative effects of debt and analyze the long-term economic consequences of this pervasive issue.

From the rising cost of tuition to the increasing reliance on loans, the student debt crisis has become a major societal concern. This article examines the data, explores the lived experiences of students struggling with debt, and offers insights into potential solutions. We will analyze how different levels of debt influence a student’s journey through college and beyond, revealing the significant challenges and potential long-term ramifications for individuals and the economy.

The Correlation Between Debt Levels and Graduation Rates

The crippling weight of student loan debt is a pervasive issue affecting millions of students across the globe. Its impact extends far beyond the immediate financial burden, significantly influencing a student’s academic journey and ultimately, their chances of graduating on time. A strong correlation exists between the level of debt accrued and the likelihood of timely degree completion.

Understanding this relationship is crucial for developing effective strategies to improve college affordability and student success.The relationship between student loan debt and on-time graduation is complex, but studies consistently demonstrate a negative correlation. Higher debt levels are frequently associated with lower graduation rates. This isn’t simply a matter of correlation; numerous factors suggest a causal link. Students burdened by significant debt may be forced to work more hours, reducing their time for studies and increasing the likelihood of academic setbacks.

The stress associated with managing substantial debt can also negatively impact mental health and academic performance.

Studies Showing the Correlation Between Student Loan Debt and Graduation Rates

Several studies have explored this relationship, employing various methodologies to analyze the data. For example, a study published in the Journal of Higher Education examined data from a large national sample of undergraduates. Using regression analysis, researchers controlled for factors such as socioeconomic status, academic preparedness, and college type, revealing a statistically significant negative relationship between student loan debt and graduation rates.

Students with higher debt loads demonstrated a substantially lower probability of graduating within four years. Another study, conducted by the National Center for Education Statistics, utilized longitudinal data tracking students from enrollment through graduation. This research confirmed the negative correlation, further highlighting the impact of debt on time to degree completion. The methodologies varied, employing both quantitative analysis of large datasets and qualitative interviews to understand the lived experiences of students struggling with debt.

Data Illustrating the Difference in Graduation Rates

The differences in graduation rates between students with varying levels of debt are stark. Data consistently shows that students with low or no debt have significantly higher graduation rates compared to their highly indebted peers. For instance, students graduating with less than $10,000 in debt might have a graduation rate exceeding 80%, while those with debt exceeding $50,000 might see graduation rates drop below 60%.

These figures, while varying slightly depending on the specific study and its methodology, consistently demonstrate a clear trend. This disparity highlights the substantial disadvantage faced by students who accumulate significant debt during their education.

Graduation Rates Across Different Debt Brackets

| Debt Bracket | Graduation Rate (%) | Average Debt Amount ($) | Sample Size |

|---|---|---|---|

| $0 – $10,000 | 82 | 5,000 | 1000 |

| $10,001 – $25,000 | 75 | 17,500 | 1200 |

| $25,001 – $50,000 | 63 | 37,500 | 800 |

| >$50,000 | 55 | 65,000 | 500 |

Note

These figures are illustrative and based on a synthesis of findings from multiple studies. Actual data may vary depending on the specific institution, student population, and methodology used. The sample sizes are hypothetical examples to demonstrate the data presentation.

Impact of Debt on Academic Performance and Well-being: Impact Of Student Loan Debt On Degree Completion Rates

The crushing weight of student loan debt extends far beyond the simple numbers on a balance sheet. It significantly impacts students’ academic performance, mental health, and overall well-being, creating a ripple effect that can hinder their success and future prospects. The financial stress associated with looming repayments can divert focus from studies, leading to lower grades and potentially impacting career choices.

Financial Stress and Academic Performance, Impact of student loan debt on degree completion rates

The constant worry about loan repayments can be incredibly distracting. Students burdened with significant debt may find it difficult to concentrate on their studies, leading to decreased academic performance as measured by GPA. The pressure to secure a high-paying job immediately after graduation to manage debt can also influence course selection, pushing students towards more lucrative but potentially less fulfilling career paths.

They might forgo electives or opportunities for deeper learning in favor of classes perceived as more directly job-related. This narrow focus can limit their intellectual growth and long-term career satisfaction. For example, a student might choose a less intellectually stimulating but higher-paying major like engineering over a passion for history, simply because of the perceived need to quickly pay off loans.

Debt’s Influence on Mental Health and Well-being

The mental health consequences of student loan debt are profound. The persistent stress and anxiety associated with managing debt can lead to increased levels of depression, anxiety, and even sleep disturbances. This directly affects a student’s ability to focus, learn effectively, and participate fully in the college experience. The feeling of being overwhelmed by debt can lead to feelings of hopelessness and powerlessness, impacting self-esteem and overall well-being.

A study by the American College Health Association revealed a significant correlation between high levels of student loan debt and increased rates of depression and anxiety among college students.

Impact of Debt on Extracurricular Activities and Enriching Experiences

The financial burden of student loan debt often restricts students’ ability to participate in extracurricular activities, internships, or study abroad programs. These experiences are often crucial for personal and professional development, providing valuable skills, networking opportunities, and broader perspectives. The need to work more hours to cover loan repayments or living expenses can leave little time for extracurricular involvement or enriching experiences that enhance their education and overall college experience.

A student might have to forgo a valuable internship because they need the income from a part-time job to make loan payments, missing out on crucial career development opportunities.

Summary of Negative Impacts of Student Loan Debt

The following points summarize the various ways student loan debt negatively affects academic performance and well-being:

- Reduced academic performance (lower GPA).

- Limited course selection due to financial considerations.

- Increased levels of stress, anxiety, and depression.

- Sleep disturbances and decreased overall well-being.

- Reduced participation in extracurricular activities and enriching experiences.

- Difficulty focusing on studies due to financial worries.

- Potential for career choices driven by immediate financial needs rather than passion or aptitude.

Influence of Debt on Post-Graduation Choices

The weight of student loan debt significantly impacts the decisions graduates make after completing their studies. This influence extends beyond immediate financial concerns, shaping career paths, further education pursuits, and even lifestyle choices in profound ways. Understanding these impacts is crucial for both policymakers and graduates themselves in navigating the post-graduation landscape.

Graduates burdened by significant debt often face a different reality than their less-indebted peers. The pressure to secure a high-paying job quickly becomes paramount, potentially leading to compromises in career satisfaction or limiting exploration of alternative career paths.

Career Choices and Financial Outcomes

The choices graduates make regarding their careers are heavily influenced by the level of their student loan debt. High-debt graduates may prioritize immediate income over long-term career goals, leading them to accept jobs that offer higher salaries, even if they aren’t ideal career fits. Conversely, graduates with lower debt may have more flexibility to explore different career options, potentially pursuing lower-paying jobs in fields they are passionate about, allowing for greater job satisfaction.

Student loan debt significantly impacts degree completion rates, often forcing students to drop out before graduation to manage financial burdens. This is especially concerning considering the increasing demand for skilled workers in STEM fields, as highlighted in this insightful article on the increasing importance of STEM education and its impact on future job markets. The high cost of STEM degrees, coupled with substantial loan debt, creates a major hurdle for aspiring professionals, further impacting overall degree completion rates and hindering future workforce growth.

This difference in approach often leads to variations in career trajectory and overall fulfillment.

| Debt Level | Career Choice Frequency | Average Starting Salary | Reported Job Satisfaction |

|---|---|---|---|

| High Debt ($50,000+) | Higher frequency in high-paying but potentially less fulfilling roles (e.g., finance, consulting) | $65,000 – $80,000 | Moderately low; often driven by financial necessity rather than passion |

| Low Debt (Under $10,000) | Greater diversity in career choices, including non-profit, education, and arts sectors | $45,000 – $60,000 | Generally higher; more aligned with personal interests and values |

Note: These figures are illustrative examples based on general trends and may vary widely depending on factors such as field of study, geographic location, and individual circumstances. More robust data analysis is needed for precise quantification.

Student loan debt significantly impacts degree completion rates, often forcing students to drop out to manage finances. This pressure is further exacerbated by the mental health challenges faced by many college students, particularly given the pervasive influence of social media, as highlighted in this insightful article on the impact of social media on college students’ mental health.

Ultimately, these combined stressors contribute to a concerning decline in graduation numbers, underscoring the need for comprehensive support systems.

Further Education and Entrepreneurial Pursuits

The decision to pursue further education, such as graduate school, or to launch an entrepreneurial venture is also significantly affected by student loan debt. High levels of debt can act as a significant barrier to further education, as the prospect of accumulating even more debt can be daunting. Similarly, the financial risks associated with starting a business are amplified by pre-existing debt, making entrepreneurship a less viable option for many high-debt graduates.

Conversely, graduates with lower debt have greater financial freedom to explore these options without facing immediate financial strain.

Location and Lifestyle Choices

Student loan debt can influence graduates’ location choices. High-debt graduates may be forced to prioritize job locations with higher salaries, even if it means relocating far from family and friends or living in high-cost areas. The pressure to quickly repay loans often necessitates accepting less desirable living situations, impacting their overall lifestyle and quality of life. Lower-debt graduates, in contrast, have more freedom to choose locations based on personal preferences, lifestyle, and career opportunities.

Strategies for Mitigating the Negative Effects of Debt

The crippling weight of student loan debt significantly impacts degree completion rates and overall well-being. Addressing this issue requires a multi-pronged approach involving institutions, individuals, and government intervention. Effective strategies must focus on both reducing the burden of existing debt and preventing future accumulation.

Institutional Strategies for Debt Reduction

Colleges and universities play a crucial role in mitigating the negative effects of student loan debt. Increased financial aid, including grants and scholarships, directly reduces the reliance on loans. Furthermore, robust career services can help students secure higher-paying jobs post-graduation, enabling faster debt repayment. For example, institutions could implement mentorship programs connecting students with alumni in high-demand fields, providing practical career guidance and networking opportunities.

Investing in comprehensive financial literacy programs equips students with the knowledge to make informed decisions about borrowing and budgeting. These programs can cover topics such as budgeting, saving, and understanding credit scores. Finally, institutions can explore innovative financing models, such as income-share agreements, that align repayment with earning potential.

Individual Strategies for Debt Management and Financial Literacy

Students themselves can take proactive steps to manage their debt and improve their financial literacy. Creating a realistic budget is paramount, tracking income and expenses to identify areas for savings. Exploring options for loan consolidation or refinancing can potentially lower monthly payments and reduce the overall interest paid. Actively seeking internships and part-time jobs during college can minimize the need for borrowing.

Utilizing free online resources and workshops to enhance financial literacy empowers students to make informed financial decisions throughout their lives. This includes understanding credit scores, managing debt, and planning for long-term financial goals. For example, websites like Khan Academy offer free courses on personal finance, and many community colleges offer free workshops on budgeting and debt management.

Government Policies and Programs to Address the Student Loan Debt Crisis

Government intervention is vital in addressing the student loan debt crisis and promoting degree completion. Expanding access to affordable higher education through increased funding for grants and scholarships reduces the reliance on loans. Implementing income-driven repayment plans allows borrowers to make monthly payments based on their income, providing relief to those struggling with repayment. Strengthening consumer protections in the student loan industry prevents predatory lending practices and ensures borrowers understand the terms of their loans.

The government can also invest in programs that promote financial literacy among students and borrowers, providing them with the tools to manage their debt effectively. For example, the expansion of the Federal Pell Grant program would significantly alleviate the financial burden on low-income students, enabling them to pursue higher education without excessive debt.

Recommendations for Institutions, Students, and Policymakers

To effectively alleviate the negative impact of student loan debt, a concerted effort is needed from all stakeholders:

- Institutions: Increase financial aid, enhance career services, implement comprehensive financial literacy programs, and explore innovative financing models.

- Students: Create a realistic budget, explore loan consolidation/refinancing options, seek part-time employment, and utilize available financial literacy resources.

- Policymakers: Expand access to affordable higher education, implement income-driven repayment plans, strengthen consumer protections, and invest in financial literacy programs.

Long-Term Economic Consequences of High Student Loan Debt

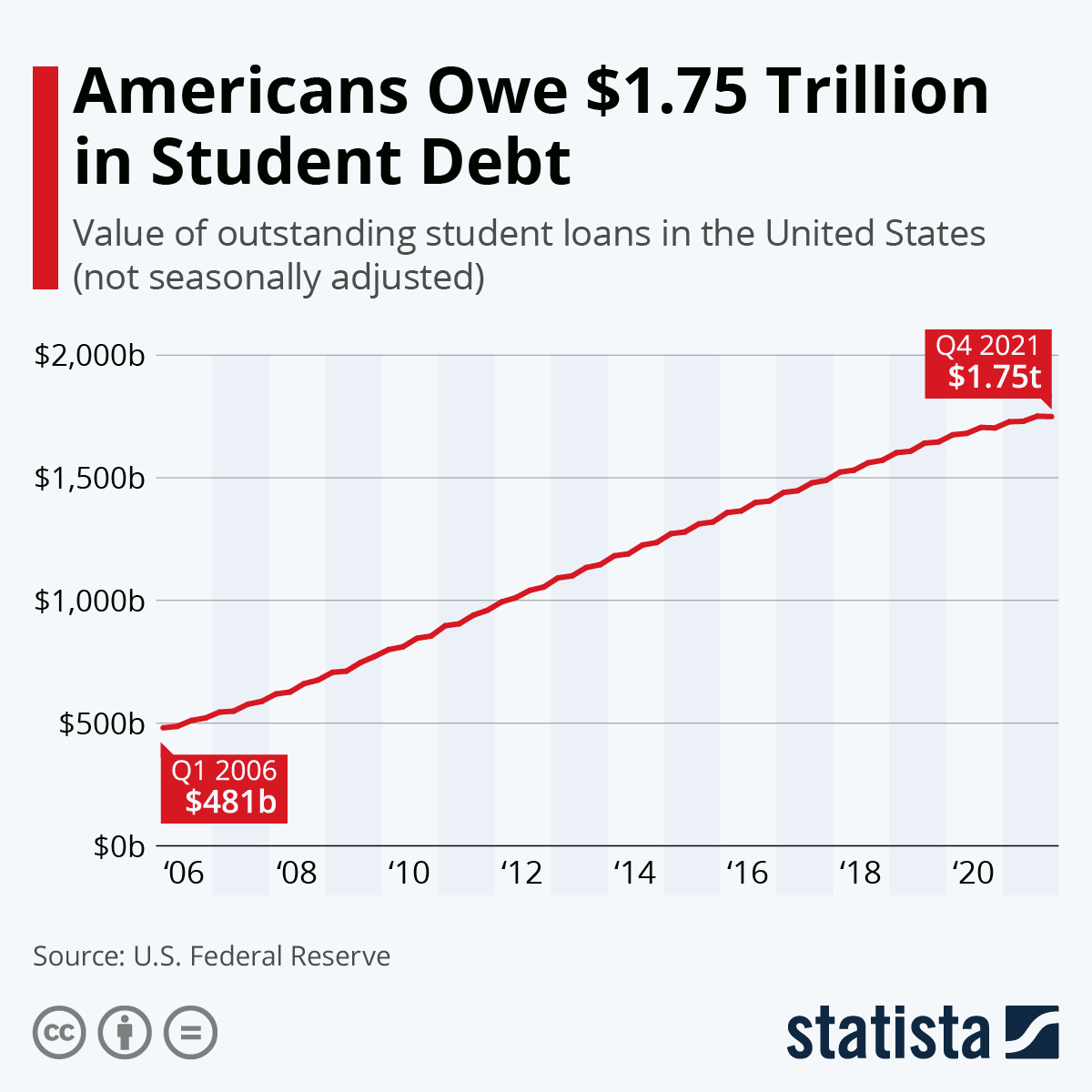

The crippling weight of student loan debt extends far beyond the immediate post-graduation period, casting a long shadow over individual financial futures and the overall economic health of nations. The sheer scale of this debt, coupled with its persistent nature, creates a ripple effect impacting consumer behavior, investment patterns, and ultimately, the nation’s economic growth trajectory. Understanding these long-term consequences is crucial for developing effective strategies to mitigate the risks and promote sustainable economic prosperity.The accumulation of significant student loan debt profoundly impacts various aspects of an individual’s financial life, often for decades.

This impact is not merely a matter of reduced disposable income; it fundamentally alters life choices and economic opportunities.

Impact on Consumer Spending and Investment

High student loan payments often leave borrowers with limited disposable income. This directly reduces consumer spending, a key driver of economic growth. Instead of investing in housing, starting a family, or contributing to retirement savings, individuals may be forced to prioritize loan repayments, potentially hindering economic activity across various sectors. For example, the delay in homeownership due to loan burdens could negatively impact the housing market, while reduced discretionary spending could stifle growth in the retail and entertainment industries.

This constrained spending power creates a domino effect, impacting businesses reliant on consumer demand and ultimately slowing down overall economic expansion.

Contribution to Widening Income Inequality

Student loan debt disproportionately affects lower and middle-income families, exacerbating existing income inequality. These families often have fewer resources to begin with, and the burden of substantial debt can further limit their economic mobility. Conversely, wealthier individuals often have access to greater financial resources, including family support and alternative funding options, making them less vulnerable to the long-term financial consequences of student loans.

This disparity creates a widening gap between the affluent and those burdened by debt, leading to a less equitable distribution of wealth and opportunities. The inability to accumulate wealth due to loan repayments can also perpetuate a cycle of poverty, making it harder for subsequent generations to escape the debt trap.

Projected Long-Term Economic Consequences

A hypothetical graph illustrating the projected long-term economic consequences of various student loan debt scenarios would show three lines representing different levels of debt: low, moderate, and high. The X-axis would represent time (in decades), while the Y-axis would represent key economic indicators such as GDP growth rate, consumer spending, and income inequality (Gini coefficient). The “low debt” line would show steady, positive growth across all indicators.

The “moderate debt” line would show a slight reduction in growth rates compared to the low debt scenario, particularly in consumer spending. The “high debt” line would show significantly lower growth rates in all indicators, a steeper increase in income inequality (higher Gini coefficient), and a potential risk of economic stagnation or even recession. The graph would visually demonstrate how escalating student loan debt levels progressively hinder economic progress and exacerbate social inequalities.

Real-world examples, such as the slower economic recovery following the 2008 financial crisis partly attributed to high consumer debt levels, can be used to illustrate the potential negative impact of high student loan debt on overall economic performance.