Return on investment for different degree programs: Choosing a degree is a major life decision, a significant financial commitment often influencing your entire future. But how do you know which path offers the best return? This isn’t just about salary; it’s about weighing the financial benefits against the intangible rewards like career satisfaction and personal growth. Let’s dive into the numbers and explore the ROI of various degree programs, from STEM fields to humanities and beyond.

This exploration will dissect various methodologies for calculating ROI in higher education, considering factors like tuition costs, potential salaries, and even the often-overlooked impact of student loan debt and program length. We’ll compare and contrast the ROI across different academic disciplines, providing you with a clearer understanding of what to expect from your investment in higher education.

Return on Investment in Higher Education

Choosing a degree program is a significant investment, both financially and personally. Understanding the return on that investment (ROI) is crucial for making informed decisions about your future. While the immediate focus often rests on potential salary, a holistic view reveals a much richer picture of the true ROI of a college education.Factors Influencing ROI Extend Beyond SalaryCalculating the ROI of a degree program isn’t simply a matter of subtracting tuition costs from projected lifetime earnings.

Choosing a degree program is a big financial decision; understanding the return on investment (ROI) for different fields is crucial. However, your earning potential isn’t solely determined by your major; it’s also significantly impacted by your soft skills. Check out this article on the importance of developing strong communication skills in the workplace after college to see how vital effective communication is for career success, ultimately boosting your ROI regardless of your degree.

Mastering communication can significantly enhance your long-term earning potential, making your degree investment even more worthwhile.

Numerous factors contribute to the overall value proposition, including career satisfaction, personal growth, and intangible benefits that significantly impact long-term well-being and success. A high salary in a job you despise offers a poor ROI compared to a moderately paying job in a field you’re passionate about.

Understanding the return on investment (ROI) for different degree programs is crucial for future financial stability. Before diving into specific numbers, however, remember to carefully consider your career aspirations and interests; check out this helpful guide on how to choose the right college major based on career goals and interests to make an informed decision. Ultimately, aligning your major with your passions can significantly impact your long-term earning potential and overall ROI.

Intangible Benefits of Higher Education

Beyond the quantifiable aspects, higher education provides numerous intangible benefits that significantly enhance an individual’s life. These benefits are difficult to assign a monetary value to, but their impact on overall well-being and success is undeniable. These benefits contribute to a higher quality of life, impacting not just individual fulfillment but also broader societal progress.For example, a degree often leads to improved critical thinking and problem-solving skills.

These skills are transferable across various aspects of life, improving decision-making in personal finances, relationships, and even everyday challenges. Furthermore, higher education frequently fosters networking opportunities, connecting students with professionals and peers who can influence their career paths and provide invaluable support throughout their lives. The development of strong communication skills, essential for both professional and personal success, is another intangible benefit that often results from higher education.

These skills are crucial for effective collaboration, leadership, and personal expression. Finally, the enhanced self-confidence and increased sense of accomplishment associated with completing a degree program contribute significantly to a positive self-image and overall well-being. These intangible benefits, while not directly reflected in a salary figure, contribute significantly to the overall return on investment of a college education.

Data Collection and Methodology for ROI Calculation

Calculating the return on investment (ROI) for a degree program requires a methodical approach, balancing the significant upfront costs of tuition and living expenses against the anticipated future earnings. This process is crucial for prospective students and policymakers alike, providing a framework for informed decision-making about higher education. Understanding the methodologies and data sources involved is essential for accurate and meaningful ROI calculations.Accurately assessing the ROI of a degree program involves several steps, from identifying relevant data sources to applying appropriate analytical techniques.

Different methods exist for calculating ROI, each with its strengths and weaknesses. The choice of method depends on the available data and the specific goals of the analysis. One key factor to consider is the time value of money, acknowledging that money earned today is worth more than the same amount earned in the future.

Methods for Calculating ROI

Several methods can be employed to calculate the ROI of a degree program. A common approach is discounted cash flow (DCF) analysis, which accounts for the time value of money. This involves projecting future earnings, discounting them back to their present value using a discount rate (reflecting the risk associated with the investment), and then subtracting the initial investment costs.

Other simpler methods might focus on comparing average starting salaries of graduates to the total cost of education, providing a less nuanced but potentially quicker estimate.

Data Sources for ROI Calculation

Reliable data is crucial for accurate ROI calculations. Several sources provide the necessary information. Tuition costs and other expenses (books, fees, living costs) are typically readily available from the university’s website or financial aid office. Salary expectations are more challenging to determine. Government sources like the Bureau of Labor Statistics (BLS) in the US, or equivalent agencies in other countries, provide average salary data for various occupations.

However, these are averages and don’t reflect individual earning potential, which can vary significantly based on factors like experience, location, and the specific employer. Private sector data providers, such as salary survey websites, can offer more granular data, though often at a cost. Alumni networks can also provide valuable insights into post-graduation earnings, offering a more direct measure of the program’s success.

Comparison of Data Collection Methods

| Method | Data Sources | Advantages | Disadvantages |

|---|---|---|---|

| Discounted Cash Flow (DCF) Analysis | University financial aid office, BLS salary data, salary survey websites, alumni networks | Accounts for time value of money, provides a more comprehensive picture of ROI | Requires detailed projections and assumptions, can be complex to implement |

| Simple Return on Investment (ROI) | University financial aid office, BLS salary data | Easy to calculate and understand | Does not account for the time value of money, may not accurately reflect the true ROI |

| Net Present Value (NPV) Analysis | University financial aid office, BLS salary data, salary survey websites, alumni networks | Considers the time value of money and allows for comparison of different investment options | Requires detailed projections and assumptions, can be complex to implement |

| Internal Rate of Return (IRR) Analysis | University financial aid office, BLS salary data, salary survey websites, alumni networks | Provides a rate of return that can be compared to other investment opportunities | Can be complex to calculate and interpret, may require iterative calculations |

ROI Analysis of Specific Degree Programs: Return On Investment For Different Degree Programs

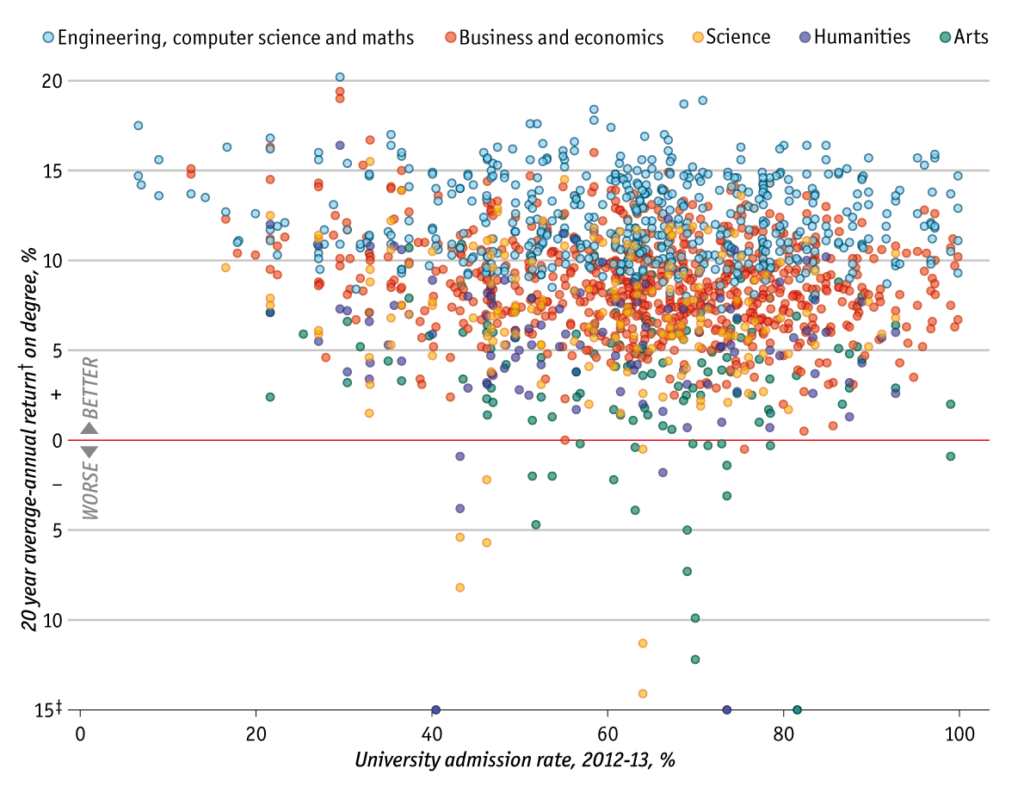

Choosing a college major is a significant investment, both financially and personally. Understanding the potential return on investment (ROI) for different degree programs can help students make informed decisions aligned with their career aspirations and financial goals. This section delves into the ROI of various STEM fields, comparing their earning potential and job market prospects.

STEM Field ROI Comparison

STEM fields consistently demonstrate strong ROI potential due to high demand and competitive salaries. However, the specific ROI varies significantly depending on the chosen specialization. Computer Science, for instance, often boasts higher starting salaries and faster career progression than certain engineering disciplines. Conversely, Biology degrees may require further specialization or advanced degrees to achieve comparable earning potential. This disparity highlights the importance of considering not just the overall field but the specific degree program and its associated career paths.

Factors Influencing STEM ROI

Several factors contribute to the variation in ROI across different STEM fields. Demand for specific skills plays a crucial role. For example, the rapid growth of artificial intelligence and machine learning has dramatically increased the demand for computer scientists specializing in these areas, leading to higher salaries and increased job security. Conversely, certain engineering specializations might experience periods of lower demand, affecting salary levels and job prospects.

Geographic location also plays a significant part; STEM professionals in major tech hubs like Silicon Valley or Austin, Texas, generally command higher salaries than those in other regions. Finally, the individual’s skills, experience, and networking capabilities significantly impact their earning potential, regardless of their chosen STEM field. A highly skilled and well-connected engineer will likely earn more than a less experienced counterpart, even within the same specialization.

STEM Career Paths and Salaries

Understanding potential career paths and associated salaries is crucial for evaluating the ROI of a STEM degree. The following provides a snapshot of potential career options, typical starting salaries (these are estimates and can vary based on location, experience, and employer), and projected growth. Note that these figures are based on current market trends and projections and may fluctuate over time.

- Computer Science:

- Software Engineer: Starting salary: $75,000 – $110,000; Projected growth: High

- Data Scientist: Starting salary: $90,000 – $130,000; Projected growth: Very High

- Cybersecurity Analyst: Starting salary: $70,000 – $100,000; Projected growth: High

- Engineering (Various Disciplines):

- Mechanical Engineer: Starting salary: $65,000 – $90,000; Projected growth: Moderate

- Electrical Engineer: Starting salary: $70,000 – $95,000; Projected growth: Moderate to High

- Chemical Engineer: Starting salary: $70,000 – $90,000; Projected growth: Moderate

- Biology:

- Biotechnologist: Starting salary: $60,000 – $85,000; Projected growth: Moderate to High (dependent on specialization)

- Pharmaceutical Scientist: Starting salary: $75,000 – $100,000; Projected growth: Moderate to High

- Research Scientist: Starting salary: $55,000 – $80,000; Projected growth: Moderate (often requires advanced degree)

ROI Analysis of Specific Degree Programs: Return On Investment For Different Degree Programs

Investing in a college education is a significant financial commitment, and understanding the potential return on that investment is crucial. While STEM fields often dominate ROI discussions, humanities and social sciences also offer valuable career paths, albeit with different trajectories and challenges in quantifying their financial returns. This section analyzes the ROI of several humanities and social science degrees, considering both monetary and non-monetary benefits.

Return on Investment in Humanities and Social Sciences Degrees

The return on investment for humanities and social science degrees is often less straightforward than for STEM fields. Directly correlating a specific degree to a guaranteed high salary is difficult. Many careers in these fields emphasize skills like critical thinking, communication, and problem-solving, which are highly valued across various industries, but not always reflected in initial salary offers.

Furthermore, career paths are often less linear, with individuals potentially changing roles and industries over their careers. This makes calculating a simple ROI using traditional financial models challenging. However, considering the long-term career prospects, the potential for personal and professional growth, and the non-monetary benefits, a holistic assessment is necessary.

Career Paths and Salary Expectations for Humanities and Social Science Graduates

The following table provides a comparative analysis of potential career paths for graduates in History, English, Sociology, and Psychology, highlighting the range of salary expectations and job outlook. Note that these figures represent median salaries and job outlook projections, and individual experiences may vary significantly. Data is based on averages from sources like the Bureau of Labor Statistics (BLS) and other reputable career resources, and represents a snapshot in time subject to change.

| Degree | Career Path | Median Salary (USD) | Job Outlook |

|---|---|---|---|

| History | Archivist, Historian, Museum Curator, Policy Analyst | $60,000 – $90,000 | Moderate growth, depending on specialization |

| English | Writer, Editor, Professor, Technical Writer, Communications Specialist | $50,000 – $80,000 | Moderate growth, with higher demand for specialized skills |

| Sociology | Social Worker, Market Research Analyst, Urban Planner, Sociologist | $55,000 – $85,000 | Moderate growth, with opportunities in government and non-profit sectors |

| Psychology | Psychologist, Counselor, Human Resources Specialist, Market Research Analyst | $60,000 – $120,000 (wide range due to specialization) | Strong growth, particularly for specialized areas like clinical psychology |

Non-Monetary Benefits of Humanities and Social Science Degrees

While quantifying financial ROI is a key consideration, the value of a humanities or social science education extends beyond monetary compensation. These degrees cultivate critical thinking, communication, research, and analytical skills – highly transferable skills valuable across diverse professions. Furthermore, they foster empathy, cultural understanding, and ethical reasoning, contributing to well-rounded individuals capable of navigating complex societal challenges.

These non-monetary benefits are difficult to quantify but represent a significant return on investment in terms of personal and professional development. For instance, a history major might find their research and analytical skills highly valuable in a legal career, while an English major’s communication skills could be crucial in a marketing role. These transferable skills represent a significant, though intangible, return on investment.

ROI Analysis of Specific Degree Programs: Return On Investment For Different Degree Programs

Choosing a degree program is a significant investment, both financially and personally. Understanding the potential return on investment (ROI) is crucial for making informed decisions. This section delves into the ROI of various business and finance degrees, comparing their potential earnings and career paths. We’ll examine factors influencing post-graduation success and illustrate high-ROI scenarios.

Business and Finance Degree ROI Comparison, Return on investment for different degree programs

Different business and finance degrees offer varying paths to financial success. Accounting degrees, for example, often lead to stable, well-paying positions in corporate settings or public accounting firms. Finance degrees can open doors to investment banking, portfolio management, or financial analysis roles, often associated with higher earning potential but potentially higher risk. Marketing degrees provide skills for a wide range of industries, offering diverse career options with varying salary ranges.

Finally, management degrees equip graduates with leadership and organizational skills applicable across various sectors, leading to diverse career trajectories and earning potentials. While precise ROI figures vary based on individual performance, location, and market conditions, general trends show higher average earnings for finance and potentially accounting graduates compared to marketing and management, although the latter two offer broader career options.

High-ROI Career Trajectories in Business and Finance

Consider the following examples: An accounting graduate might start in a mid-sized firm, gradually progressing to senior roles and potentially becoming a partner, earning significantly higher salaries over time. A finance graduate could begin in financial analysis, transition to portfolio management, and eventually manage substantial investment portfolios, commanding high compensation packages. A marketing graduate might build expertise in digital marketing, securing a high-paying role at a tech startup or leading a marketing team for a major corporation.

A management graduate could climb the corporate ladder, progressing to leadership positions with significant responsibility and remuneration. These examples illustrate how strategic career progression, specialization, and skill development contribute to a high ROI on a business or finance education.

Impact of Networking and Internships on ROI

Networking and internships are crucial for maximizing ROI in business and finance. Internships provide practical experience, building skills and connections within the industry. They often serve as stepping stones to full-time employment, potentially offering a head start in salary negotiations. Networking events, industry conferences, and alumni connections facilitate access to job opportunities and mentorship, accelerating career advancement.

Strong professional networks can open doors to unadvertised positions and high-impact roles, significantly boosting earning potential. For example, a finance graduate with a strong internship at a prestigious investment bank and a robust professional network is significantly more likely to secure a high-paying role than a graduate with limited experience and connections. Similarly, a marketing graduate with strong internship experience and industry contacts might secure a higher-level position early in their career.

Factors Affecting ROI

Choosing a degree program is a significant financial investment, and understanding the factors that influence its return is crucial. While potential earnings are a key component, the overall ROI is heavily impacted by two significant variables: the level of student loan debt accumulated and the time it takes to complete the program. These factors, often intertwined, significantly affect the speed and magnitude of your return.Student loan debt significantly impacts the overall ROI calculation because it represents an upfront cost that reduces the net profit from your future earnings.

The larger the loan, the longer it will take to recoup the investment, even with a high-earning potential career. This is because a substantial portion of your early post-graduation income will be allocated to loan repayment, delaying the point at which you start to see a positive return on your investment. The interest accrued on these loans further compounds this effect, increasing the total cost over time.

Student Loan Debt’s Influence on ROI

The impact of student loan debt can be substantial. Consider a hypothetical scenario involving two graduates with the same degree in Computer Science. Both secure jobs with an annual starting salary of $75,000. However, Graduate A took out $50,000 in student loans, while Graduate B managed to graduate with only $10,000 in debt. Graduate A will dedicate a larger portion of their salary to loan repayment, thus experiencing a significantly lower net income in the initial years after graduation compared to Graduate B.

This delay in realizing a positive return directly impacts the overall ROI calculation, making Graduate B’s ROI considerably higher despite both earning the same salary. The interest rate on the loans also plays a crucial role; a higher interest rate will further diminish Graduate A’s ROI. Sophisticated ROI calculations incorporate these interest payments and their compounding effect over time to provide a more accurate representation of the investment’s true return.

Program Length and its Impact on ROI

The duration of a degree program directly affects both the total cost and the time it takes to recoup the investment. A longer program, such as a medical degree (typically 4 years of undergraduate study plus 4 years of medical school), naturally incurs higher tuition costs, living expenses, and potentially longer periods of forgone earnings during the study period.

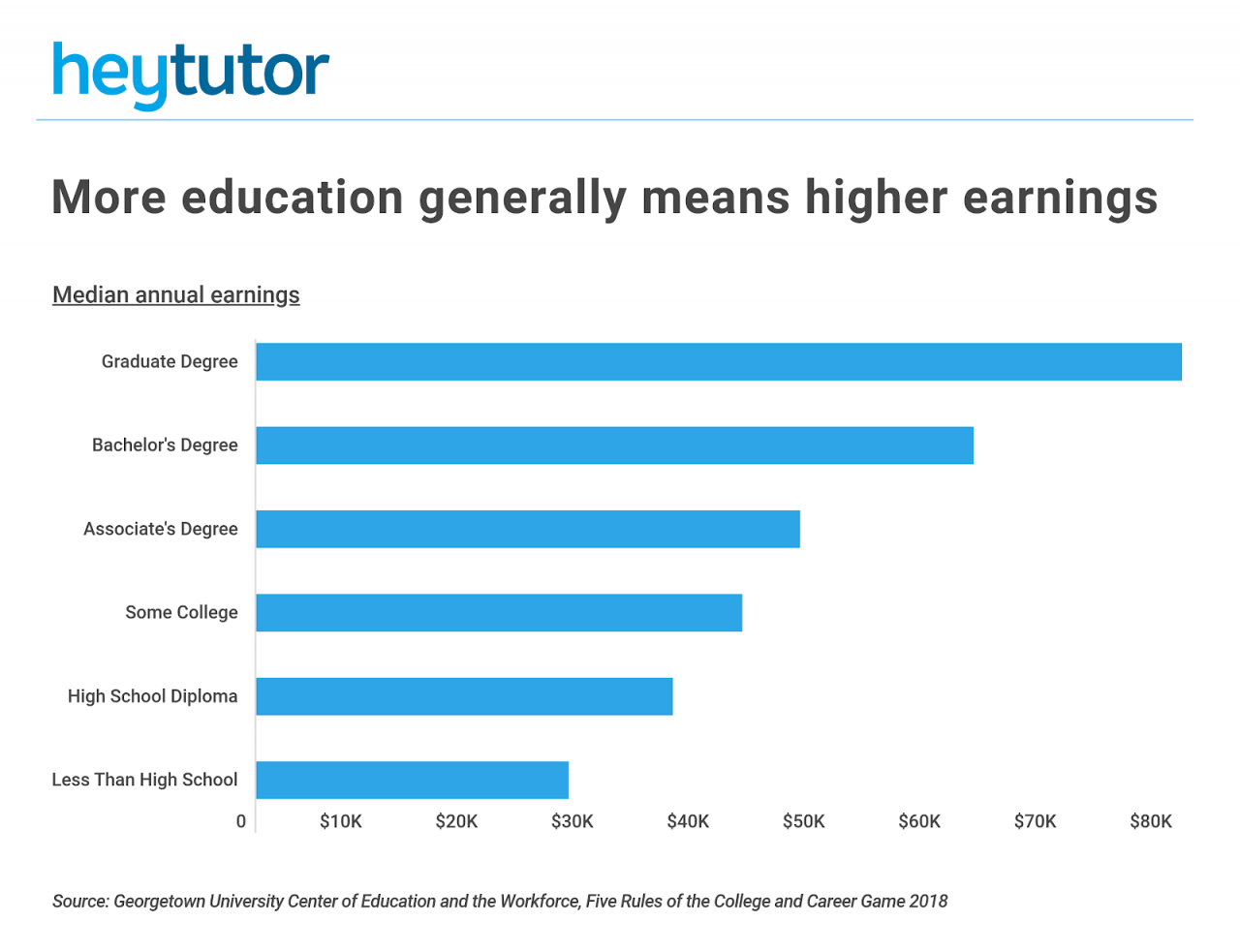

This extended timeframe increases the overall investment and delays the point at which the graduate begins earning a salary to offset the costs. Conversely, a shorter program, like an Associate’s degree, might involve lower overall costs and a quicker return on investment, although the earning potential associated with such a degree might be lower than that of a longer program.

For instance, a shorter program might lead to a faster return on investment, but the potential salary might not be as high, impacting the overall long-term ROI. Therefore, a comprehensive ROI analysis needs to consider the trade-off between the duration of the program, its associated costs, and the potential long-term earning capacity of the chosen career path.

Long-Term vs. Short-Term ROI Considerations

Choosing a degree program is a significant investment, and understanding the return on that investment requires considering both short-term and long-term perspectives. While immediate post-graduation salary is a factor, the true value of a degree often unfolds over a much longer timeframe. This section delves into the nuances of short-term versus long-term ROI, highlighting the factors that influence long-term career success and illustrating how some degrees offer greater long-term value than initially apparent.Short-term ROI focuses on the immediate financial benefits after graduation, such as starting salary and the speed at which student loan debt can be repaid.

Long-term ROI, however, encompasses career progression, salary increases over time, and the overall impact of the degree on one’s earning potential throughout their career. It considers factors like job satisfaction, career stability, and opportunities for advancement. The optimal choice depends on individual circumstances, career goals, and risk tolerance.

Factors Contributing to Long-Term Career Growth and Increased Earning Potential

Several factors significantly impact long-term career growth and increased earning potential. These factors often intertwine and build upon each other to create a trajectory of sustained success. For instance, continuous learning and professional development are essential for remaining competitive in a rapidly evolving job market. Networking and building strong professional relationships can open doors to new opportunities and advancements.

Furthermore, demonstrated leadership skills and the ability to adapt to changing industry demands are crucial for long-term career success.

Examples of Degree Programs with Significant Long-Term ROI

Consider the field of medicine. While the path to becoming a doctor requires extensive education and significant financial investment, the long-term ROI is substantial. The high earning potential, coupled with job security and the ability to contribute meaningfully to society, makes it a prime example of a career path with a strong long-term ROI, even if the initial years post-graduation involve significant debt repayment.

Similarly, careers in engineering and technology, while potentially requiring substantial upfront investment in education, often yield significant long-term financial returns due to consistently high demand for skilled professionals and the potential for significant salary increases throughout a career. These careers often involve continuous learning and adaptation, which further contributes to their long-term earning potential. Finally, advanced degrees in fields like law or business administration can lead to substantial increases in earning potential over time, although the initial investment and potential for a slower initial salary increase should be considered.

Visual Representation of ROI Data

Understanding the return on investment (ROI) for different degree programs is crucial for prospective students and their families. Effectively communicating this complex data requires clear and concise visual representations that highlight key trends and comparisons. Visualizations not only simplify the information but also make it more engaging and memorable, ultimately aiding informed decision-making.Visualizing ROI data allows for quick comparisons between various degree programs and their projected earnings over time.

This facilitates a more intuitive understanding of the potential financial benefits of higher education, enabling individuals to make more strategic choices aligned with their career aspirations and financial goals. Different visualization methods, each with its strengths and weaknesses, can be employed to effectively convey this information.

Bar Charts for Comparing ROI Across Degree Programs

Bar charts are excellent for comparing the ROI of different degree programs at a specific point in time, such as after 10 years. Imagine a bar chart where the x-axis represents various degree programs (e.g., Engineering, Business, Nursing, Arts). The y-axis would represent the projected ROI, expressed as a percentage or a dollar amount. Taller bars would indicate higher ROI for that particular degree program.

For instance, a bar chart might show Engineering having the highest ROI at 150%, followed by Business at 120%, Nursing at 100%, and Arts at 80%. This visual immediately highlights the relative financial returns of each field. Error bars could be added to represent the uncertainty inherent in ROI projections, adding a layer of realism.

Line Graphs for Illustrating ROI Over Time

Line graphs are ideal for showing the change in ROI over a period of time. A line graph could illustrate the projected ROI of a specific degree program (e.g., Engineering) over 10 years. The x-axis would represent the years (0-10), and the y-axis would represent the cumulative ROI. The line would show the increase in ROI as the graduate gains experience and higher-paying positions.

For example, the line might start at 0% at year 0 and steadily increase, reaching 150% by year 10. Multiple lines could be plotted on the same graph to compare the ROI trajectories of different degree programs. This allows for a direct visual comparison of how the ROI of different programs changes over time.

Illustrative Example: A Combined Bar and Line Graph

A sophisticated visualization could combine elements of both bar and line graphs. Imagine a chart with multiple lines representing the ROI of different degree programs over 10 years. At the end of the 10-year period (year 10 on the x-axis), bars could be added to the graph, showing the final ROI for each program. This combined visualization provides a comprehensive view of both the trajectory and the final outcome of ROI for each degree program.

The height of the bars at year 10 would directly correspond to the final point of each line, making the comparison clear and intuitive. For example, the Engineering line would end with a tall bar representing its high ROI, while the Arts line would end with a shorter bar, reflecting its lower ROI. This combined approach offers a richer, more informative picture than either chart alone.